What are ESG criteria?

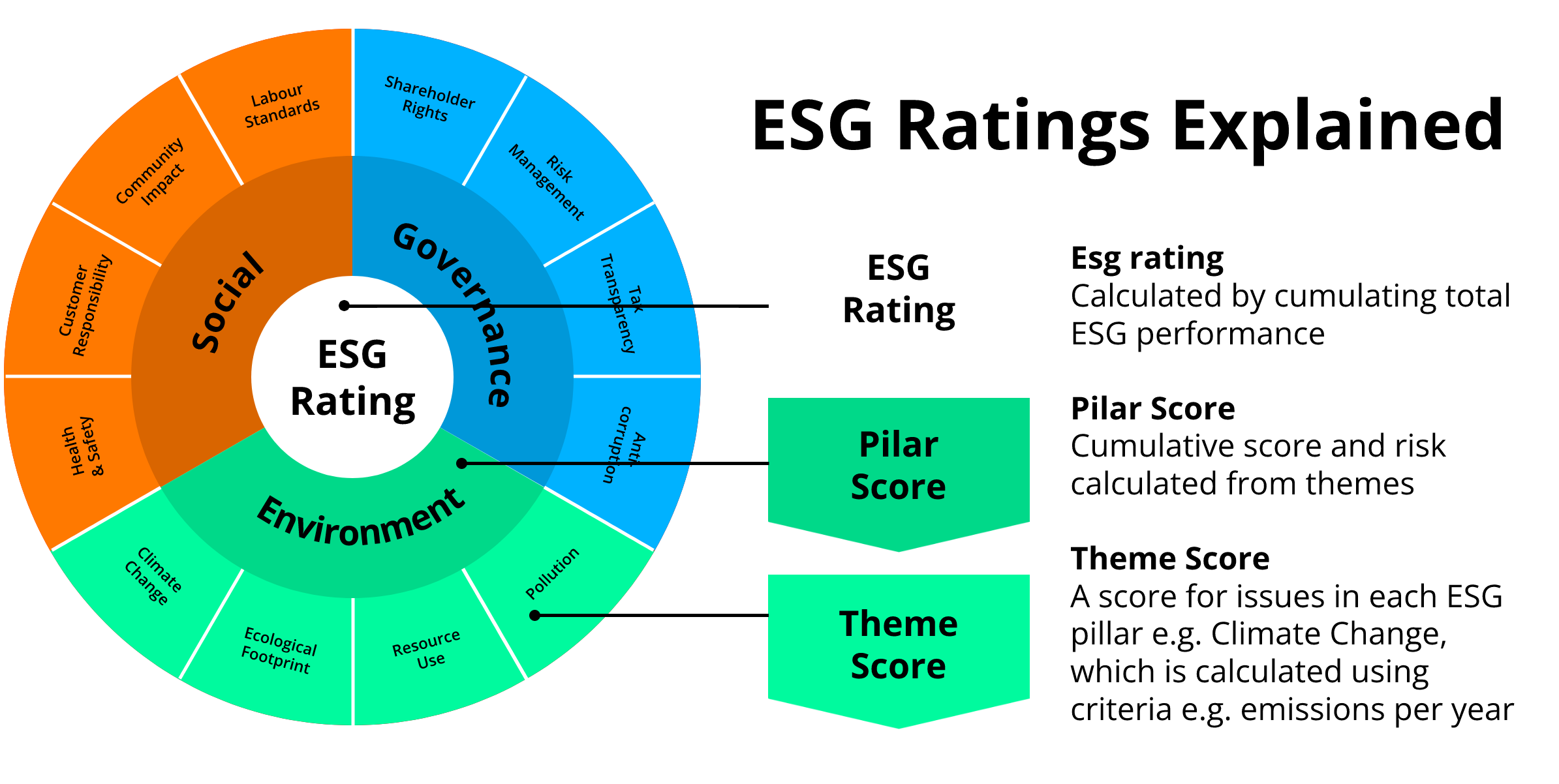

ESG (Environmental, Social and Governance) criteria are used by socially conscious investors and shareholders to screen investments and assess a company’s impact on the world. They affect how your company will gather and retain funding from investment funds who have a ’socially responsible’ investment strategy.

Being able to impress socially conscious investors, it’s necessary to maintain a high ESG rating by looking at how you’re conducting your business operations, not just how much money you’re making.

The ‘3 pillars’ Environmental, Social, Governance explained

ESG criteria are separated into 3 main pillars which have been defined by Investopedia as the following:

Environmental criteria consider how a company performs as a steward of nature, acting responsible towards our planet. This includes:

- Action on climate change

- Greenhouse gas emissions and reductions

- Water and natural resources usage

- Pollution and waste management

Social criteria examine how it manages relationships with employees, suppliers, customers and the communities where the company operates. Themes include:

- Diversity, Inclusion and Equality

- Labour standards

- Health and safety performance

- The way a company treats clients and customers

- Company’s impact in their community

Governance criteria deal with a company’s leadership, executive pay, audits, internal controls and shareholder rights. This includes:

- Anti-corruption and anti-money laundering measures

- Tax transparency

- How decisions are made across the executive board

Why is ESG important?

There are several financial benefits that correlate to companies that pursue a high ESG performance:

More attractive to investors. Green investment funds and socially responsible investors are more likely to fund companies with good ESG scores.

Better performance. A study by leading asset manager Amundi, showed that between 2014–2017, company’s portfolios with high ESG scores outperformed competing investments.

More attractive for customers. A growing demand of green & sustainable products and services is rising across the globe in different industries. New generations are more likely to buy products that make them feel they are contributing to save the planet.

Better financial indicators. MSCI reports that high-ESG companies experience lower cost of capital, less volatile earnings and lower market risk compared to low-ESG companies

Additionally, KPMG reports some examples of long-term benefits created by ESG activities.

Adaptability. Evolving business models minimise the impact of disruption from technology or regulation.

Innovation. Technological advancements in fostering a sharing economy that promotes innovation and improves efficiency.

Prepared for Regulation. The adoption of or investment in renewable energy infrastructure and technology to reduce carbon emissions and costs arising from environmental tax or payments for offsetting carbon emissions.

Positive brand image. Companies with high ESG values experience better retention rates and a more positive brand recognition amongst their staff and customers.

Do you still have any doubts about ESG?

Send us a message and we will come back to you with an answer.